Municipal Taxation

The Corporate Services Department is responsible for property tax items such as billing and collection of all interim, final and supplementary property tax, Commercial and Industrial vacant unit rebate program, Registered Charity rebate program, property tax adjustments (such as section 357/358 applications under the Municipal Act), Assessment Review Board (ARB) decisions and request for reconsiderations that adhere to the Assessment Act.

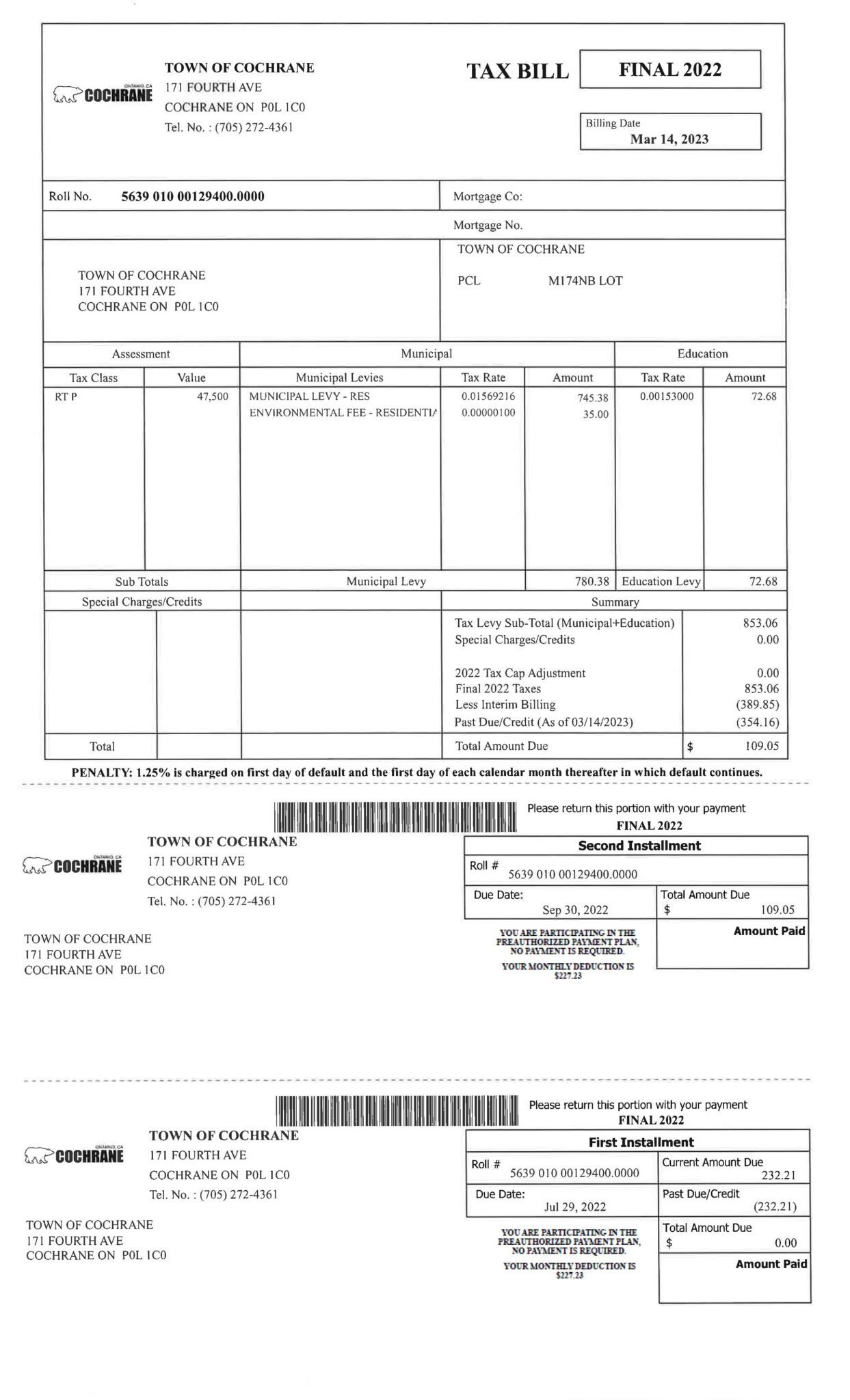

Understanding Your Tax Bill

Click on the letters below to view a sample of a Town of Cochrane tax bill, and the explanation behind each section of it.

Supplementary & Omitted Tax Bills

When the town issues a building permit, there will most likely be a value change in the property, which creates a supplementary or omitted assessment. Your property assessment will need to be updated to reflect the completed work as a result of the building permit. The Municipal Property Assessment Corporation (MPAC) will mail you a supplementary or omitted assessment notice. The supplementary or omitted Tax Bill will follow shortly after the MPAC notice is received.

For taxation purposes, you will receive a tax bill at a later date called a ‘supplementary’ tax bill. The supplementary tax bill will reflect the additional change in your assessment and taxes owing will be adjusted accordingly.

If the supplementary or omitted tax bill is for a new home, you, as the owner, will be responsible from the effective date of occupancy and/or possession; therefore, creating multiple year supplementary or omitted tax bills.

A supplementary assessment is an additional (increase in value) resulting from property improvements or changes, which were not reflected in the property tax bill for the current year and occurred after the return of the assessment roll. A supplementary assessment can be processed for the following reasons:

- There is an increase in property value because of a new building or improvement;

- A property ceases to be exempt from taxation or ceases to be eligible for assessment at the farm value, managed forest, or conservation lands;

- A property ceases to be classified in a subclass of real property, farmlands awaiting development, commercial or industrial vacant land;

- A property becomes liable for taxation in a different property class.

An omitted assessment is an additional assessment resulting from building a new home or addition, which was not previously recorded on the annual assessment roll. An omitted assessment can be processed for the current year and two preceding years for the following reasons:

- There is an increase in property value because of a new building or improvement;

- To assess and classify land that was previously exempt;

- A property ceases to be classified as managed forest or conservation land.

If the supplementary notice is for additions or improvements to your property then your taxes will increase. Keep in mind that your land may have been previously assessed, your supplementary or omitted tax bill will only be for the structure portion of the property. Meaning future years will combine these two assessments.

If your supplementary notice is only for a change in classification, the municipality applies a new tax rate to your property and adjusts the previous calculation with the new information supplied by MPAC. The new tax rate could be higher or lower than what was previously billed. Retain all your MPAC forms to verify your data agrees with all affected documents.

The bill must be paid by the due date indicated on your tax bill. Additional assessment occurring from building a new home or addition can result in a supplementary tax bill that can amount to thousands of dollars. It is wise to plan for this billing as soon as you start work on your property by putting money aside on a monthly basis to pay the bill when it comes due.

Note: If you are enrolled in the pre-authorized payment plan, any supplementary tax bill issued must be paid separately by the due date indicated on your tax bill, unless notified differently by our office. Should this be your case, please contact the Tax department to discuss the possibilities.

Lisa Kennedy

Property Tax Clerk

171 Fourth Avenue

Cochrane, ON P0L 1C0

Tel: 705-272-4361 ext. 230

Fax: 705-272-6068

How Taxes are Calculated

Property taxes are calculated using the current assessed value of a property and multiplying it by the combined municipal and education tax rates for the applicable class of property. This calculation is reflected on your tax bill that you receive in June each year.

To learn more about the relationship between property values and property taxes, watch the video below.

Frequently Asked Questions

You can access a wide range of tax information through this section of the website, or you can contact our Property Tax Clerk.

The Town of Cochrane mails two property tax bills per year.

Interim bill which is mailed out in January to assist municipalities until the final tax billing process is completed by the Corporate Services department. The interim tax bill is calculated using the current year assessment roll and a portion of the prior year’s tax rate (50%). The installment dates are the last business days of the following months:

- February*

- April*

Final bill which is mailed out in June is calculated by taking the current year assessment roll and the final tax rates as established by Council. The installment dates are the last business days of the following months:

- July*

- September*

*these dates do not include any Supplemental/Omitted bills due to assessment adjustments. Installment dates for Supplemental/Omitted bills vary depending on delivery date.

The Town of Cochrane offers a variety of tax payment options. Please refer to the ‘Tax Payments’ section for further details.

All cheques must be made payable to the Town of Cochrane.

Your final tax bill provides all information you require for income tax purposes.

A receipt will be provided free of charge if you attend the Town Hall at the time of payment with a copy of your tax bill. At which time our staff would stamp your bill as payment received. This can also be done if you send your payment by mail and include the copy of your bill along with a self-addressed stamped envelope, at which time we would stamp your bill and return it to you by mail. If you have paid your property taxes by cheque, your cheque acts as your receipt.

Effective July 1, 2020, taxpayers must now pay a fee of $13.00 in order to receive a formal receipt for income tax purposes, reprint of their tax bill, or any other information which appears on the final tax bill.

PLEASE NOTE: You may bring in the final tax bill to Town Hall and request that the Property Tax department confirm payment is all up to date, as well as stamp your bill as ‘paid’ at no charge.

To sign up to our pre-authorized payment plan (PAP), simply download and complete the form. Once completed, return it to our office along with a ‘void’ cheque. See our Pre-Authorized Payment Plan section for further details.

Yes, we accept post-dated cheques for all payments.

Our tax system must match the information that was registered at the Land Registry Office. These changes must therefore be made at the Registry’s office. A copy of the completed transfer must then be submitted to the Property Tax department.

For property mapping, deeds or to obtain property line information you must visit www.onland.ca. The property tax department does not have this information.

The Town of Cochrane has an administration fee of $65.00 per property tax roll for all tax certificate requests.

Before making any changes to your property, please contact our Building & Planning department or visit them at the Cochrane Fire Hall.

They will inform you of the process. The Property Tax department will then receive confirmation from the Building & Planning department and make all necessary adjustments once MPAC has adjusted the assessment, if applicable.

Yes, this new structure will add value to your property which in turn will increase the assessed value. The assessed value is multiplied by the set tax rate which gives you your total annual taxes.

The new online application makes it easier for property owners and tenants registered with MPAC to change their school support. For more information, check out the user guide available on mpac.ca or log on to www.aboutmyproperty.ca

Address Changes

Staying up to date

In order for the town to maintain an accurate and up to date database for property taxes, we must receive notification of any mailing address changes.

It is the responsibility of the property owner to notify us of any changes that affect their mailing addresses. Failure to receive a tax bill does not absolve a taxpayer from responsibility for payment of taxes or penalty & interest charges.

Request Form

Should you require an address change on your property, please notify us by completing the Change of Address Form.

Tax Rates

Residential Tax Formula

The basic formula used to calculate the residential tax rate is as follows:

- Amount to be raised by taxes / total weighted assessment = Residential Tax Rate

Once the residential tax rate has been determined, all other class tax rates will be calculated using this tax rate base and an allowable tax ratio predetermined for each class. The amount to be raised by taxes is calculated by looking at all funds that must be raised on the Council approved budget prepared by Corporate Services department. This results in the total amount to be raised through taxation.

Municipal Taxation Bylaws

Below is a table of necessary yearly municipal taxation bylaws for the Town of Cochrane. Simply click on any of the available years to access the relative documentation for that fiscal.

Paying Your Tax Bill

In Person

Pay in person by visiting the municipal office during regular business hours. You can pay in the following ways:

- Cash

- Cheque

- Money Order

- Debit (no credit card payments will be accepted)

Online banking is also available (please see below for additional information on this payment method).

Pre-Authorized Payment Plans

Below are three available payment plans that allow for automatic withdrawals:

- Installment Plan: This plan has 4 withdrawals scheduled per year. The withdrawals occur on the dates as per the installment stubs of the tax bills mailed.*

- Monthly Plan: This plan has 10 withdrawals scheduled per year. It runs from February to November yearly. The withdrawals occur on the 15th of these months. A document showing the calculated amount of the 5 withdrawals are attached to the interim & final billing mailed to the ratepayers.*

*In order to qualify, taxes must be paid in full prior to sign-up. - Arrears Plan: This plan has 12 monthly withdrawals and occur on the last business day of the month. This plan is ideal for ratepayers on fixed incomes as they decide the monthly amount.

Please Note: There is a $42.00 NSF charge for any rejected payments. In addition, after 2 infractions the PAP option is removed and will no longer be a payment option for the ratepayer.

Pre-authorized payment form

Please fill out the Preauthorized Payment Plan Form and submit to our office along with a VOID cheque.

Telephone & Internet Banking

Tax payments may be made over a secure internet site by registering with your financial institution for online banking services.

Financial Institution

Payments may be made at CIBC, Scotiabank and Caisse Populaire on or before the due date. Taxpayers are required to present their tax bill at the time of payment. The financial institution may charge a fee for this service.

Lisa Kennedy

Property Tax Clerk

171 Fourth Avenue

Cochrane, ON P0L 1C0

Tel: 705-272-4361 ext. 230

Fax: 705-272-6068

Payment Application & Late Payment Charges

Payments must be received on or before the due date to avoid late payment charges. You may postdate your cheque for the due date and mail it in at your earliest convenience. If paying online, please be aware of your bank’s processing times. Payments will be recorded the day the payment is received by the Town of Cochrane’s financial institution.

The penalty and interest charge for late tax payments is 1.25%. Penalties and Interest are charged on the outstanding tax levies on the first business day of the following month.

Notice of Tax Arrears & Reminder Notices

The Town of Cochrane issues reminder & arrears notices for past due levies during the following months:

- March: Reminder Notice | Sent after the first interim billing installment date has passed.

- May: Reminder Notice | Sent after the second interim billing installment date has passed.

- August: Reminder Notice | Sent after the first final billing installment date has passed.

- October: Reminder Notice | Sent after the second final billing installment date has passed.

- November: Arrears Notice | Encouraging prompt payment and urges contact with the tax department

- December: Tax Sale Registration Pending Notice | These notices are the first step in the tax sale registration process. Should you receive this notice, the Town of Cochrane Property Tax department urges you to contact us promptly to avoid tax registration and additional tax sale processing fees.

Tax Rebates & Reductions

Vacant Unit Rebate

Section 364 of the Municipal Act, 2001 provides for rebates to vacant business units at the same percentage as discounts afforded to property owners of vacant and excess land. These percentages are 30% for commercial properties and 35% for industrial properties.

Property owners who are eligible for a rebate must submit an application to the municipality each year that a building, or portion of a building, is vacant. To be eligible for a rebate, a building or portion of a building must satisfy the following:

- Buildings that are entirely vacant: A whole commercial or industrial building will be eligible for a rebate if the entire building is vacant for at least 90 consecutive days.

- Buildings that are partially vacant: A suite or unit within a commercial building will be eligible for a rebate if, for at least 90 consecutive days it was:

- A: Unused and clearly delineated or physically separated from the used portions of the building.

- B: Either capable of being leased for immediate occupation, or not capable of being leased for immediate occupation because it was undergoing or in need of repairs or renovation or was unfit for occupation.

A portion of an industrial building will be eligible for a rebate if, for at least 90 consecutive days, it was:

- A: Unused and clearly delineated or physically separated from the used portions of the building.

The deadline to submit an application for a tax year is February 28th of the following year.

Charitable Organizations Rebate

Under Section 361(1) of the Municipal Act, 2001, every municipality shall have a tax rebate program for eligible charities for the purpose of giving them relief from taxes on eligible property they occupy.

The program is applicable to registered charities that are tenants in a commercial or industrial class property. Deadline for the current year is February 28th of the following year. The minimum percentage prescribed for the calculation of a rebate is 40%.

Registered charities must apply every year for the rebate by completing an application and submitting it to the Property Tax department prior to the deadline.

Property Tax Rebate Program

for Low-Income Seniors and

Low-Income Persons with Disabilities

This program offers property tax relief to qualified individuals, marking the Town’s commitment to supporting its vulnerable populations.

Eligible participants can benefit from a tax credit of $250, providing valuable assistance in managing property tax expenses. This initiative represents just the start of Cochrane’s efforts to prioritize the welfare of its citizens.

Deadline to apply is May 31 of each year.

Ontario Senior Homeowners’ property grant

You can also apply for help from the Province of Ontario. The province offers grants to help low income seniors with the cost of their property taxes.

For more information, visit the Ontario Ministry of Finance.

Lisa Kennedy

Property Tax Clerk

171 Fourth Avenue

Cochrane, ON P0L 1C0

Tel: 705-272-4361 ext. 230

Fax: 705-272-6068

Application Forms

Below are links to the vacant unit rebate guide and application form. If you believe to be eligible, please download a form, fill it out, and submit it to our Property Tax Clerk.

Low Income Senior and ODSP Property Tax Rebate - French Application

Tax Certificates

A Formal Request

The Town of Cochrane, under the Freedom of Information Act cannot release tax information to the public without a formal request for a Tax Certificate. A written request must be submitted to our office along with a payment of the user fee. Effective July 1, 2020 the amount of the Tax Certificate is $65.00 per property tax roll. Tax Certificates can now be paid using a credit card as well as cash or cheque.

Once the information has been processed, we forward the certificate by email. We ask that all requests be received a minimum of 5 days before the required deadline to allow staff sufficient time to prepare the certificate.

Certificate Request

Please send your requests to the Property Tax department or email your request to our Property Tax Clerk, with a PDF of your law office letterhead, as well as a PDF of the cheque that is paying the tax certificate fee. Our office now accepts credit card payment for the Tax Certificate fee for your convenience.

Tax Sales

Unpaid Property Tax

If property taxes remain unpaid for a specific period of time, the Municipal Act, 2001 governs the circumstances under which the property may be sold by the Town of Cochrane. The Town may register a Tax Arrears Certificate against title if property taxes remain unpaid for the three years prior to January 1 of any year. These time lines apply to both residential and non-residential classes of property.

A Tax Arrears Certificate indicates that the property will be sold if the cancellation price is not paid within one year of registration of the certificate. Once a certificate has been registered, partial payments cannot be accepted unless the owner has entered into an extension agreement with the Town before the expiry of the one-year period.

The Town may advertise the property for sale for non-payment of taxes if the ‘cancellation price’ is not paid within one year of registration of the certificate. Advertisements are generally published in the Cochrane Times Post for four consecutive weeks and the Ontario Gazette for one week. Tender packages may be found online or at Town Hall.

For legislation governing the tax sale process, including definitions, please refer to the Municipal Act, 2001, S.O. 2001, c.25, including Ontario Regulation 181/03.

Tax Sale Property

Take Notice that tenders are invited for the purchase of the land(s) described below and will be received until 3:00 p.m. local time on JUNE 12, 2025, at the TOWN HALL OFFICE, 171 Fourth Avenue, Cochrane, ON P0L 1C0.

The tenders will then be opened in public on the same day a soon as possible after 3:00 p.m. at the TOWN HALL OFFICE, 171 Fourth Avenue, Cochrane, ON P0L 1C0.

Description of Lands:

139-143 FIFTH AVENUE

PIN 65244-1034

PCL 1307, SEC; LAG SRO; N 30 FT, LT 270; PLAN M114NB GLACMEYER; TOWN OF COCHRANE; and

PIN 65244-1035

PCL 1761, SEC; LAG SRO; S 36 FT, LT 270; PLAN M114NB GLACMEYER; TOWN OF COCHRANE

Minimum Tender Amount: $43,783.11

For more details, click here for a copy of the Tender Package.

Property Assessments

For years, properties in Ontario have been assessed to determine their municipal taxation level. In 1970, the government of Ontario took over municipal assessments in order to standardize the process across the province. In 1998, responsibility for property assessment was transferred to the Municipal Property Assessment Corporation (MPAC).

MPAC is a not-for-profit corporation created by the Province. It delivers a broad range of assessment services to municipalities, all of which are members of the Corporation. They are responsible for assessing all properties in Ontario. These values are provided to municipalities on annual assessment rolls. Municipalities and the Province use these values when they calculate property taxes and education taxes.

How Assessments are Done

The onus is on the ratepayer to ensure that MPAC has all the correct data in order to appropriately assess your property. Please review your MPAC details online using the ‘About My Property‘ option available to all property owners. You will find your username and password on your property assessment notice mailed to you in November. Should you require assistance, please use the MPAC website to guide you. If you have filed a ‘Request for Reconsideration’, your status is now available at aboutmyproperty.ca.

Please watch the video below to learn more about how MPAC assesses residential properties in Ontario.

Assessment Review Board

If you wish to file a formal complaint with the Assessment Review Board (ARB). The ARB is an independent tribunal of the Province of Ontario. Starting in 2009, if your property or a portion of it is classified as residential, farm or managed forest, you must first complete the RFR process with MPAC before you are eligible to file an appeal with the ARB.

Application forms can be obtained by contacting the ARB by telephone, by visiting the ARB website, or can be picked up at the local MPAC office. There is a fee for filing a complaint with the ARB. Please contact the ARB for applicable fees. The deadline for filing a complaint for the current tax year is 90 days after MPAC has notified you of its decision on your RFR or March 31st of the taxation year if your property has no residential, farm or managed forest classification.

Both the property owner and MPAC will be asked to appear at a hearing to present evidence to support their arguments. The decision of the Board is final and binding on both parties. You can find out more about the assessment appeal process on the ARB website or by calling their toll free number at (800) 263-3237.

Municipal Property Assessment Corporation

Links & Documents

Below are important links and documents related to property assessments with the Municipal Property Assessment Corporation.